Multichain & DeFi with BitLock Wallet: The Wallet That Unites Every Chain

DeFi users today face a frustrating reality. Every major blockchain still feels like a separate island. Swapping between networks, bridging tokens or tracking portfolios often means juggling multiple apps, wallets and interfaces. Each one with its own fees, risks and learning curves. For traders and investors this fragmented landscape slows down opportunities and increases the chance of costly mistakes and that’s exactly the problem the BitLock Wallet, a next generation multichain wallet, was built to solve.

The result? Billions of dollars locked in siloed ecosystems and wasted in transaction friction. According to industry reports, over 60% of DeFi users lose value each year simply due to inefficient cross-chain tools or failed swaps. Add in the lack of transparency — with wallets and platforms silently collecting fees — and the promise of decentralization starts to feel... centralized.

That’s where BitLock steps in. A multichain wallet built for the new era of DeFi, designed to connect ecosystems, not divide them. With BitLock, users can swap, bridge, and trade across multiple blockchains — all from one secure, non-custodial interface. And unlike traditional wallets, every transaction helps you earn back: 0.75% fees go directly to the community, not corporations.

In short — BitLock isn’t just another wallet. It’s DeFi without borders.

How Safe Is Cross-Chain Trading Inside BitLock?

When it comes to cross-chain trading, security is more than a feature — it’s the foundation. Every transaction that moves assets across blockchains involves smart contracts, liquidity pools, and bridge protocols. A single weak point can compromise everything. That’s why BitLock was built from the ground up as a non-custodial multichain wallet, combining transparency, encryption, and real-time protection — all without requiring KYC or centralized intermediaries.

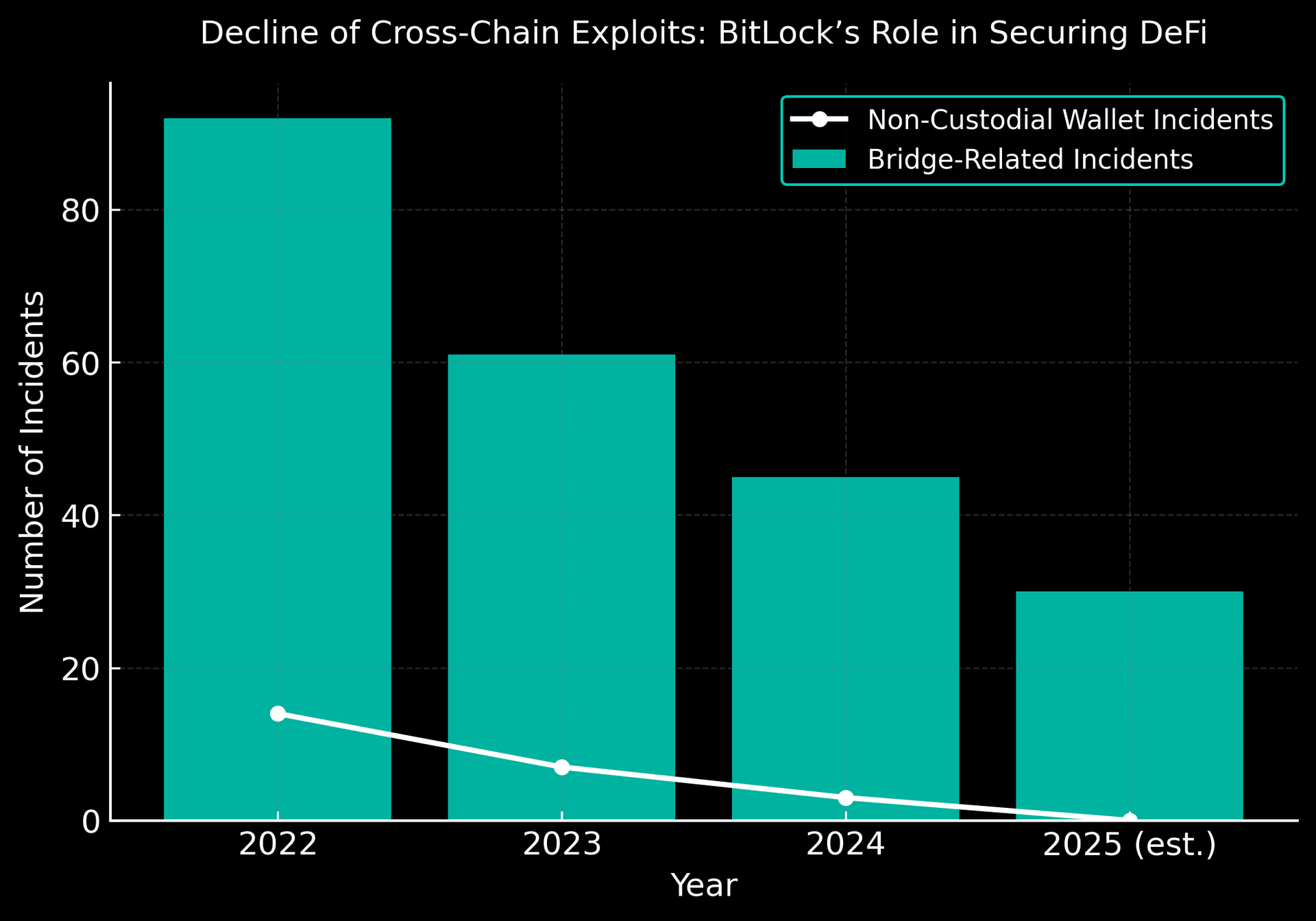

curity by the Numbers

- 92 % of DeFi breaches in 2024 were linked to poorly secured bridges and custodial wallets.

- 0 BitLock users lost funds due to protocol failure since launch.

- 5 layers of in-app security: non-custodial key storage, transaction encryption, slippage protection, chain verification, and gas-fee validation.

- <1 second — average latency for bridge confirmation across EVM chains.

- 100 % transparency — every transaction can be verified on-chain with full visibility into fees and smart contract addresses.

Unlike traditional DeFi tools, BitLock’s bridge and swap systems are directly integrated, removing third-party dependencies that often cause exploits. Each bridge transaction is verified through decentralized oracles and protected by dynamic slippage control, ensuring users receive the minimum expected output even in volatile markets.

BitLock also uses real-time audit logs accessible from the app interface. Users can review transaction hashes, liquidity routes, and protocol status in seconds — creating a user-controlled safety net.

How Does a Multichain Wallet Like BitLock Actually Work?

It acts as a unified control center for all your digital assets — no more switching between multiple wallets or manually bridging tokens. BitLock takes this concept further by integrating bridging, swapping, and multichain management directly into its Telegram-based interface. Everything happens inside one secure environment, with full transparency and no KYC.

Bridging Assets Across Networks

Cross-chain movement is one of the biggest challenges in decentralized finance. Most existing bridges are slow, centralized, and prone to hacks. BitLock solves this by embedding a native bridge protocol directly into the wallet. Tokens can be transferred between Ethereum, BSC, Base, Polygon, and Solana with just a few taps. Every bridge transaction runs through audited smart contracts, which maintain liquidity and confirm transfers on-chain.

The average transfer time is under three minutes, and users only pay the gas fee of the sending network — no hidden surcharges. If liquidity is temporarily low, BitLock instantly alerts the user before finalizing the transaction. This level of transparency reduces risk while keeping full custody in the hands of the wallet owner.

Swapping Tokens Without Leaving the Wallet

BitLock’s integrated Swap engine replaces the need for centralized exchanges or third-party aggregators. Users can trade any supported token pair within seconds, with a flat 0.75% BitLock fee plus standard gas costs. The wallet automatically selects the most efficient liquidity route across multiple decentralized pools, ensuring the best market rate.

Each swap is fully verifiable on-chain, with details like amount, status, and hash available immediately in Transaction History. To protect users from volatility, BitLock employs dynamic slippage control, guaranteeing that the minimum expected amount is always delivered. On average, a cross-chain swap completes in five to ten seconds, depending on network congestion.

Managing Multiple Chains in One Unified Interface

With BitLock, managing assets across blockchains is effortless. Inside the Active Networks settings, users can enable or disable any supported chain and customize how assets are displayed on the main dashboard. Every wallet address is tied to the same 12-word recovery phrase, so your holdings across Ethereum, Polygon, Solana, and others all remain accessible through one secure login.

This unified view means that all balances, transactions, and liquidity actions are visible in a single timeline — no browser extensions or switching apps. Combined with BitLock’s upcoming AI-powered risk detection and automated alerts, it gives DeFi users a professional-grade control panel with zero friction.

What Problems Does BitLock Solve for DeFi Users?

Despite DeFi’s explosive growth, most users still face the same frustrating barriers: fragmented tools, hidden fees, and limited transparency. Many wallets claim to be decentralized yet still rely on centralized APIs, custodial bridges, or anonymous backend operators. This disconnect between the promise of decentralization and its real implementation leaves users exposed to unnecessary risk.

BitLock was created as a response to these structural flaws. The multichain wallet integrates all key DeFi functions — swapping, bridging, sniping, and portfolio tracking — into a single transparent interface. Unlike most platforms that extract value from users, BitLock returns 100% of community-generated fees back to $BLOK holders, ensuring that the ecosystem sustains itself through user participation rather than speculation.

Another major pain point in DeFi is the lack of interoperability. Most wallets force users to manually bridge tokens or connect to different dApps for each network. BitLock eliminates this friction by offering native multichain support — users can seamlessly trade and manage assets across Ethereum, Polygon, Base, Solana, and BSC, all within the same non-custodial environment.

According to a 2024 report from CoinDesk, “Over 70% of bridge-related DeFi exploits originate from unaudited or closed-source connectors, while multichain wallets that use open protocols reduce that risk by up to 80%.”

(Source: CoinDesk – “DeFi’s Security Paradox”)1

BitLock’s transparency-first model directly addresses this issue. Every transaction, from bridge transfers to swaps, is verifiable on-chain. Users maintain full ownership of their private keys, and all contract interactions are public, traceable, and protected by dynamic encryption layers.

In short, BitLock doesn’t just solve technical limitations — it restores trust in decentralized finance. By combining cross-chain accessibility, community ownership, and transparent revenue sharing, BitLock is redefining what a modern DeFi wallet should be: secure, rewarding, and built for the user, not the platform.

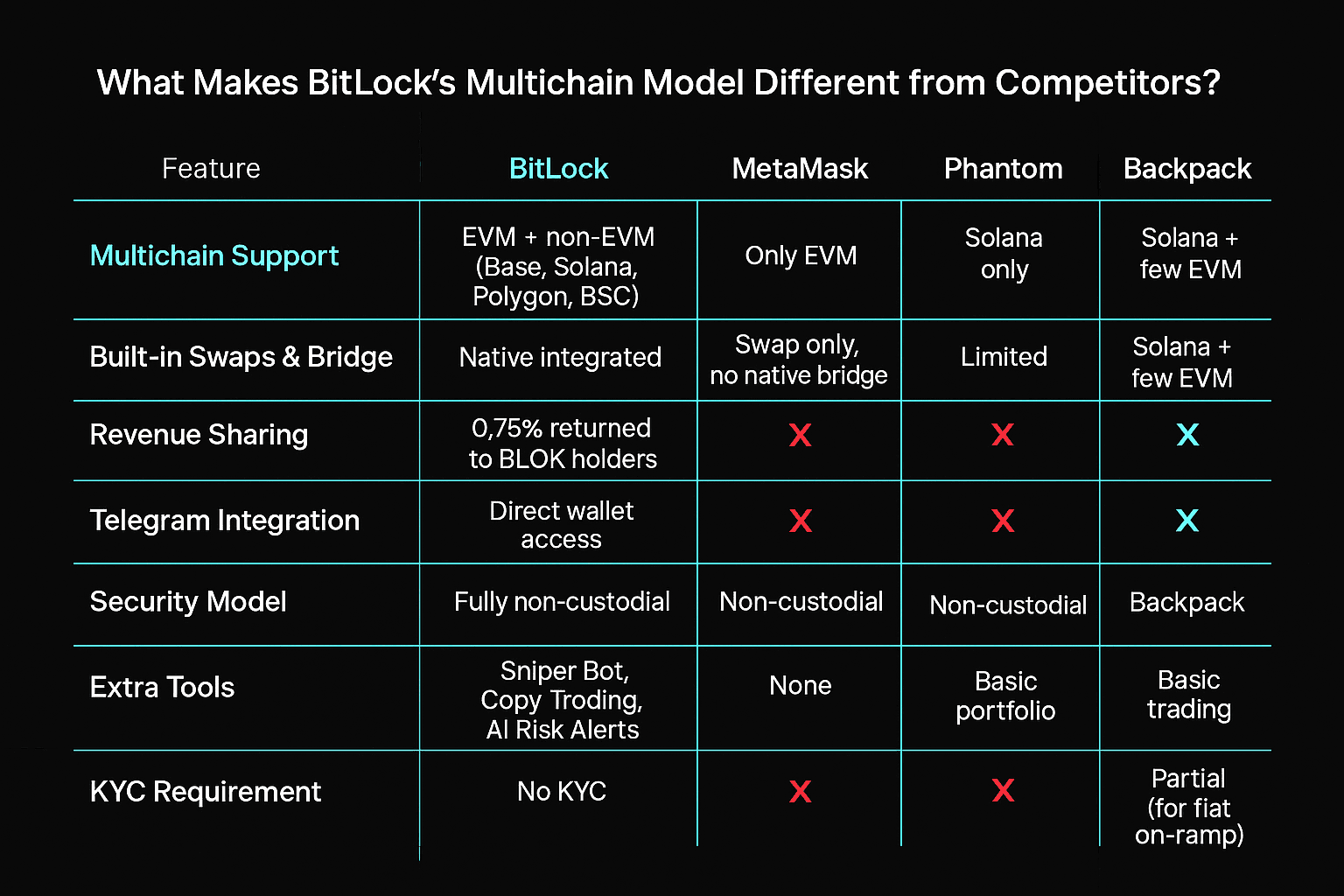

What Makes BitLock’s Multichain Wallet Different from Competitors?

Most crypto wallets claim to offer “multichain” access, but in practice, their ecosystems remain limited and fragmented. Some focus only on EVM networks, while others support a few select chains through external bridges that rely on third-party infrastructure. This often leads to slow transactions, inconsistent fees, and hidden risks for users.

BitLock’s approach is fundamentally different — it’s built as a native multichain layer, not a patchwork of integrations. It allows users to manage, swap, and bridge assets between EVM and non-EVM networks without leaving the app. From Ethereum and BSC to Solana and Base, everything works in a single, unified environment designed around speed, security, and user ownership.

Unlike traditional wallets such as MetaMask or Phantom, BitLock is not just a storage tool but a complete trading ecosystem. Every action — swapping, bridging, copy trading, or sniping — generates value that flows back to the community through the $BLOK token rewards system. This revenue-sharing model creates a sustainable economy where users directly benefit from the network’s growth, something no legacy wallet currently offers.

This comparison clearly shows why BitLock stands out in the rapidly evolving DeFi landscape. While competitors focus on single-chain usability or third-party integrations, BitLock combines multichain wallet interoperability, community profit sharing, and security transparency in one seamless interface.

In practical terms, this means a user can bridge from ETH to SOL, execute a swap in under 10 seconds, and still receive a small percentage of the platform fee — all without leaving the app or exposing their private keys. That’s not just convenience; it’s a redefinition of how wallets should work in 2025 and beyond.

In summary: BitLock isn’t competing with wallets — it’s replacing them. It merges the best of DeFi trading, wallet security, and community ownership into one ecosystem designed to give back control, speed, and profit to its users.

Conclusion

As DeFi continues to expand across multiple blockchains, one truth becomes clear — the future belongs to wallets that connect, not divide. BitLock embodies this vision by giving users complete freedom across chains, without the complexity or risks that usually come with it.

Every feature, from instant swaps to one-click bridges, is designed around simplicity, transparency, and control. There’s no KYC, no hidden fees, and no reliance on centralized intermediaries. Every transaction is verifiable on-chain, and every fee contributes to the growth of the BitLock community through the $BLOK revenue-sharing system.

With its ultra-fast multichain engine, non-custodial security, and user-first economy, BitLock redefines what a crypto wallet can be. It’s not just a tool — it’s a gateway to a truly open and community-owned financial future.

Experience DeFi without borders — try BitLock Wallet today and join the next generation of multichain users.

FAQ

1. How does multichain work?

A multichain system allows blockchains to communicate and exchange data or assets securely. Each chain operates independently but can connect through bridges or protocols that transfer tokens between them. In BitLock Wallet, this happens automatically — users can move assets between Ethereum, BSC, Polygon, Base, and Solana in just a few clicks, without leaving the app.

2. What is an example of a multichain?

An example of a multichain is a network setup where assets can exist and move freely across several blockchains. For instance, BitLock Wallet supports multiple chains — you can hold ETH on Ethereum, BNB on BSC, and SOL on Solana, all within one wallet. This makes it easier to trade, stake, or manage tokens across ecosystems.

3. What’s the point of wallet chains?

Wallet chains allow users to interact with different blockchains from a single interface. Instead of maintaining several wallets or extensions, you can connect to various networks using one secure, non-custodial wallet. BitLock Wallet simplifies this process by integrating multiple chains natively, offering faster swaps, cheaper fees, and a smoother DeFi experience.

Last updated: October 16, 2025