How Does a Crypto Wallet Work? A Beginner’s Guide

Managing crypto wallets safely can feel overwhelming especially for beginners who keep hearing about lost funds, hacked exchanges, and forgotten passwords. Every year, millions of dollars vanish because users don’t understand what crypto wallets are or which one to trust. That’s why solutions like Bitlock Wallet are changing the game giving users a secure, no-KYC way to manage their assets across multiple blockchains.

The problem? Most guides are either too technical or skip the essentials. They explain blockchain jargon but not how you actually store, send, or protect your crypto. Without this foundation, even experienced traders risk losing control over their assets.

That’s why this guide breaks it all down in simple terms. You’ll learn what crypto wallets are, how they work, and how to choose one that’s secure, fast, and easy to use. And to make things even clearer, we’ll look at how Bitlock Wallet combines multi-chain access, no-KYC privacy, and reward-sharing to make managing crypto effortless for everyone.

What exactly are crypto wallets and why do you need one?

A crypto wallet is your personal gateway to the blockchain a digital tool that lets you store, send, and receive cryptocurrencies securely. Unlike a physical wallet, it doesn’t actually hold coins. Instead, it stores private keys, which are unique cryptographic signatures proving that you own your assets.

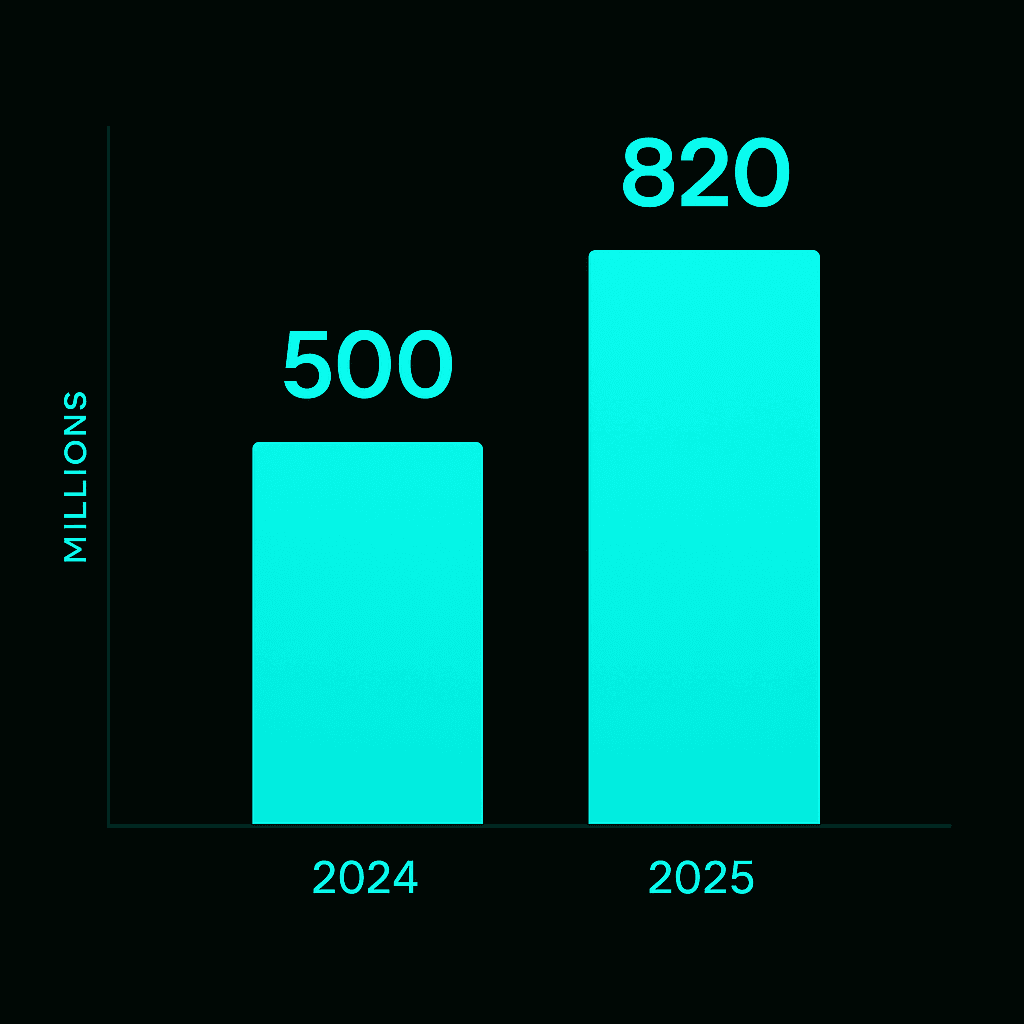

According to Chainalysis (2025), over 420 million people worldwide now use crypto wallets, and that number is expected to surpass 600 million by 2027. Yet, nearly 20% of Bitcoin supply worth more than 200 billion USD is permanently lost because users misplaced their private keys or recovery phrases. This makes choosing and managing a wallet one of the most crucial steps for any crypto investor.

There are two main categories of wallets:

- Custodial wallets, where a third party (like an exchange) holds your keys.

- Non-custodial wallets, like Bitlock Wallet, where you remain in full control of your assets.

The difference is simple but vital “Not your keys, not your crypto.” Custodial wallets are easier for beginners but carry counterparty risks, while non-custodial wallets ensure that only you can authorize transactions.

Bitlock Wallet goes a step further. It’s non-custodial, meaning your keys never leave your device, and every transaction is signed locally. You don’t need to upload any personal documents or pass KYC verification. With a single app, you can access multiple blockchains, manage your portfolio, and execute ultra-fast swaps with just a few taps.

In today’s decentralized world, having a secure crypto wallet isn’t optional it’s essential. Whether you’re storing $50 or $50,000, a wallet like Bitlock gives you the freedom, privacy, and security that centralized exchanges can’t.

How does a crypto wallet actually work behind the scenes?

Behind every crypto wallet lies a simple yet powerful system built on cryptography and blockchain technology. Instead of storing your coins directly, a wallet manages your public and private keys, allowing you to access, send, and receive digital assets securely.

When you make a transaction, your wallet uses your private key to create a digital signature that verifies ownership and authorizes the transfer. This signature is then broadcast to the blockchain, where a network of nodes confirms and records it permanently.

According to Coin Metrics (2024), over 1.2 million wallet transactions occur every hour, proving how fast and decentralized this system is. Each transaction is verified by thousands of nodes across the network making blockchain wallets far more secure than traditional online banking systems.

Bitlock Wallet takes this process one step further by performing all signature operations locally on your device. This means your keys never leave your phone or browser, eliminating risks of centralized breaches. Combined with multi-chain access (Ethereum, Solana, Base, Polygon, and BSC), Bitlock ensures that users can transact across ecosystems securely and instantly without ever exposing their identity or personal data.

If you want to understand these fundamentals in more depth, read our guide Crypto Wallets Explained, where we break down everything from seed phrases to public keys and private key encryption in simple terms.

How do public and private keys interact?

Public and private keys work like a lock and key system.

- Your public key acts as your visible address similar to an IBAN in banking that anyone can use to send crypto to you.

- Your private key is the secret password that unlocks your funds.

The wallet automatically pairs these keys through mathematical algorithms. When you sign a transaction, the blockchain uses your public key to verify the digital signature created by your private key. Without both, no transaction can occur.

In Bitlock Wallet, this process happens entirely offline, within the app’s secure local environment, protecting users even if they are connected to public Wi-Fi or unstable networks.

What role does a seed phrase play?

A seed phrase is a human-readable backup usually 12 or 24 words generated when you create a wallet. It allows you to restore access to your wallet and all associated accounts if your device is lost or damaged.

Think of it as a master key that can rebuild your digital vault from scratch. However, if someone gains access to your seed phrase, they control your entire wallet. Studies show that over 14% of wallet losses happen because users either lose or share their seed phrases unknowingly.

That’s why Bitlock never stores or transmits your seed phrase online. It’s generated and encrypted locally, leaving no trace on external servers giving you complete self-custody and privacy.

What happens when you send or receive crypto?

When you send crypto, your wallet signs a transaction request with your private key, broadcasting it to the blockchain network. Nodes validate it, add it to a new block, and update the public ledger. This process usually takes a few seconds to a few minutes, depending on the network’s speed and congestion.

When receiving crypto, the sender uses your public address, and once the transaction is confirmed on the blockchain, your wallet updates the balance automatically.

With Bitlock Wallet, this is seamless swaps, bridges, and portfolio tracking all happen within one interface. Thanks to its ultra-fast swap engine, users can exchange assets across chains in seconds while paying the lowest market fee (0.75%), without depending on centralized exchanges or third-party dApps.

What are the different types of crypto wallets available?

Crypto wallets come in several forms each designed for different levels of security, convenience, and control. Understanding these types helps users choose the right balance between accessibility and protection for their assets.

At the highest level, wallets are divided into two main categories:

- Hot wallets – connected to the internet, allowing fast access and transactions.

- Cold wallets – completely offline, offering maximum protection against hacks.

Let’s break them down further:

1. Hot wallets (software-based)

Hot wallets include mobile apps, browser extensions, and web wallets. They’re ideal for daily transactions, quick swaps, and portfolio tracking. Their biggest advantage is speed you can send or receive tokens instantly. However, being online also means they’re slightly more exposed to phishing or malware.

Bitlock Wallet is a next-generation hot wallet that removes most of these risks. It keeps your private keys locally encrypted, never stored on servers, and gives you full multi-chain access Ethereum, BSC, Polygon, Solana, and Base all in one interface. It also operates as a Telegram mini-app, making DeFi accessible in seconds without complex setups.

2. Cold wallets (hardware or paper)

Cold wallets, such as Ledger, Trezor, or even printed paper wallets, store private keys offline. They’re considered the safest way to hold large amounts of crypto long-term since they can’t be hacked remotely. The trade-off is convenience transactions require connecting the device to a computer and signing manually.

3. Custodial vs. Non-custodial wallets

Custodial wallets (like those on exchanges) manage your keys for you. They’re easy to use but rely on the company’s security, meaning you don’t truly “own” your crypto.

Non-custodial wallets such as Bitlock Wallet give you 100% control. You own your keys, your recovery phrase, and your data. No central authority can freeze or access your funds.

In the end, your choice depends on your priorities. If you value speed and flexibility, a multi-chain solution like Bitlock provides instant access with high security. If you prefer long-term safety, a hardware wallet might be a good complement. Many professionals use both one for trading and one for storage.

“A secure crypto wallet is not just a tool, but a responsibility. The future of digital finance depends on how well users manage their private keys.”

— Andreas M. Antonopoulos, author of Mastering Bitcoin1

Conclusion

Crypto wallets are more than just digital storage they are the foundation of true financial ownership in the decentralized world. Understanding what they are, how they work, and which type suits you best is the first step toward protecting your assets and using crypto confidently.

As we’ve seen, wallets come in many forms: hot, cold, custodial, and non-custodial. Each serves a purpose but only non-custodial wallets give you full control of your funds. In an ecosystem where 20% of all Bitcoin has been lost due to mismanagement or centralized failures, choosing the right wallet isn’t optional, it’s essential.

Bitlock Wallet embodies the future of this technology. It combines privacy, speed, and multi-chain access in a single app, without compromising self-custody. Users can swap, bridge, and earn rewards all while keeping their keys and identity secure.

In short, a good wallet doesn’t just store your crypto it empowers you.

If you’re ready to take control of your digital assets, explore Bitlock Wallet today and experience what secure, seamless, and rewarding crypto management feels like.

FAQ

What is a crypto wallet and how does it work?

A crypto wallet securely stores your private keys, which prove ownership of your digital assets. It lets you send, receive, and manage crypto. Bitlock Wallet does this locally on your device, your keys never leave your control.

Which crypto wallet is best?

The best wallet depends on your needs. For multi-chain access, no KYC, and built-in swaps, Bitlock Wallet stands out. It combines privacy, speed, and rewards in one app.

Can you convert a crypto wallet to cash?

Yes, you can use integrated swap or sell features to exchange crypto for fiat. Bitlock Wallet supports this through trusted on-ramp and off-ramp providers, making conversion simple and secure.

Last updated: October 20, 2025